[{Details}]SKIP A PAY REQUESTS

Members may request 2 skips within a 12-month period.

(Limited to 8 skips over the lifetime of the loan)

-

Skip A Pay Loan Eligibility

- Request cannot be made less than 10 days before the requested month’s payment due date

- Loan must be open for a minimum of 6 months

- 70 days since the last skip

- Have fewer than 2 skip requests on a loan in the past 12 months

- No more than 8 skips during the lifetime of the loan

- Loan is not in delinquency

- Member’s account must be in good standing and funds to cover the skip fee

- Member’s Loan must be in good standing

Other terms and conditions apply.

Contact a Loan Representative with questions.Loans Not Eligible for a Skip

Home Equity loans, Credit Card, Unimproved Property Loans, Loans held by a 3rd Party, Loans with CPI and Business loans are not eligible.

Please note that there is a processing fee and that each month you skip a payment will extend the term of your loan by at least one month.

[{Request}]REQUEST SKIP A PAY

Contact Us, Stop By

-or-

Make your Request in Online Banking or the Mobile App

(instructions below)

OPTION 1

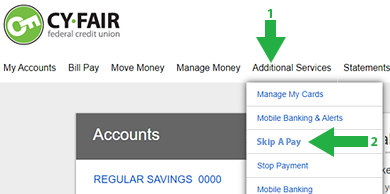

IN ONLINE BANKING:

In the top navigation menu, go to “Additional Services”

then select “Skip A Pay” in the dropdown and follow the instructions

…OR…

You may also find a “Skip A Payment” widget

in the “My Accounts” home screen of your

Online Banking Account where you can submit a request

OPTION 2

IN THE MOBILE APP

Select the “. . . More” option at the bottom,

and then select “Skip Payment”

Don’t Have Cy-Fair FCU Online Banking or Mobile App?

For members without access to online banking the skip a payment you may either

[{FAQ}]Skip-A-Pay FAQs

-

You can request a Skip-a-Pay in a financial center, over the phone, or through Online and Mobile Banking.

-

Log in to Online or Mobile banking to see if you are eligible for a Skip-a-Pay. You can also visit a financial center or call our Contact Center at 281.571.5000 to ask if you are eligible and complete a skip-a-pay.

-

Yes, there is a $25 fee for skipping your payment on any eligible Cy-Fair FCU loan.

-

Most CFFCU loans are eligible for a skip-a-payment.

Loans NOT eligible, include:

- Home Equity loans

- New loans with less than 6 months of consecutive payment history

- Credit Cards

- Delinquent loans

- Loans with Collateral Protection Insurance placed within the past 12 months -

The credit union allows eligible members to apply for a Skip-a-Pay twice in a 12 month period. You are allowed a max of 8 skip-a-pay extensions on a loan over the full term of that loan.

-

You can only skip the payment that is currently due. For example, if you want to skip December’s payment, you must wait until the November payment has been made.

-

Yes, as long as the loan qualifies for a skipped payment, you can skip a payment on multiple loans.

-

You can have the funds deducted directly from your Cy-Fair FCU Checking or Savings account. The funds must be available in your account before submitting a request.

-

Your Skip-a-Pay fee will be deducted from the account of your choice at the time of your request.

-

The skipped payment will be added to the end of your loan, extending the original loan term.

-

If you have automatic or recurring payment set-up, you will need to stop the payment for the month you are skipping. Payments that have already been made cannot be refunded.

Don’t forget to turn it back on after your skip!

*SKIP-A-PAY TERMS AND CONDITIONS

Members are limited to two (2) Skip-a-Pay extensions within a 12 month period, with a minimum of seventy (70) days and two (2) monthly payments between each skip-a-pay. Skip-a-pay extensions are limited to eight (8) for the full term of a loan.

Most CFFCU loans are eligible for a skip-a-payment. The following loans ARE NOT ELIGIBLE: Home Equity Loans, Credit Cards, Loans with Collateral Protection Insurance placed within the past 12 months, Unimproved Property Loans, New Loans with less than 6 consecutive months of pay history, and loans currently held by a 3rd Party. Additionally, members with past due (delinquent) loans or credit cards, or who have a negative account, are not eligible.

We must receive a skip-a-pay request at least 10 days before your payment due date. A fee will be charged for each skip-a-payment and funds must be available in your account prior to approval of your request.

If you have automatic or recurring payment set-up for the loan payment being skipped, you must update your scheduled payment as well. Payments that have already been made cannot be refunded.

Each month a payment is skipped will extend the term (the current maturity date) of the loan by one month. Interest continues to accrue during the skipped period. Payments will resume as scheduled following the skipped payment month. All other terms and conditions of the loan(s) will remain the same.

Members with auto loans, who have purchased GAP Insurance and elect to have more than two (2) skip-a-payment extensions over the term of the loan, will be liable for any unpaid loan balance in the event of a Constructive Total Loss. If you purchased GAP Insurance through a dealership, it is your responsibility to review how coverage may be affected by participating in Skip-A-Pay.

Other terms and conditions may apply and are subject to change. Skip payment requests are subject to approval.